Corporate in-house lawyers, particularly those working in major public companies, have very different needs from those in private practice, however large their firms might be.

What is the biggest difference? The main focus of the private practice lawyers is serving their numerous clients. Not only is it their duty to support client best interests, but clients are their source of revenue.

Corporate lawyers – especially at a senior level – have to take a more holistic view. They usually have one client – their employer – and have to be focused not only on individual cases but on the whole gamut of legal issues facing their company. They are responsible for the efficient settlement of disputes and the accurate reporting of the potential outcome of cases that embody liabilities (or assets) of the business. These will then be part of the reporting that public companies have to deliver. That in turn of course affects the share price and overall business outlook not to mention internal budgeting and overall accountability.

Just as their colleagues in other fields from HR to sales and marketing rely on a plethora of software tools, sometimes bundled into an overall ERP (Enterprise Resource Planning) platform, so in-house lawyers are increasingly turning to software to support their activities.

Why?

Here are three main reasons:

- The wide adoption of appropriate software enables collaboration across the legal department and other internal stakeholders, particularly finance;

- Software adoption across the legal department dictates a universal process that delivers standardised reporting and work methods that in turn promote flexibility across task allocation;

- Productivity and efficiency gains will ensue, with benefits to the corporate bottom line.

These generic benefits are apparent across all parts of the legal department. But these and other positive advantages are crucial when it comes to dispute valuation and settlement of cases.

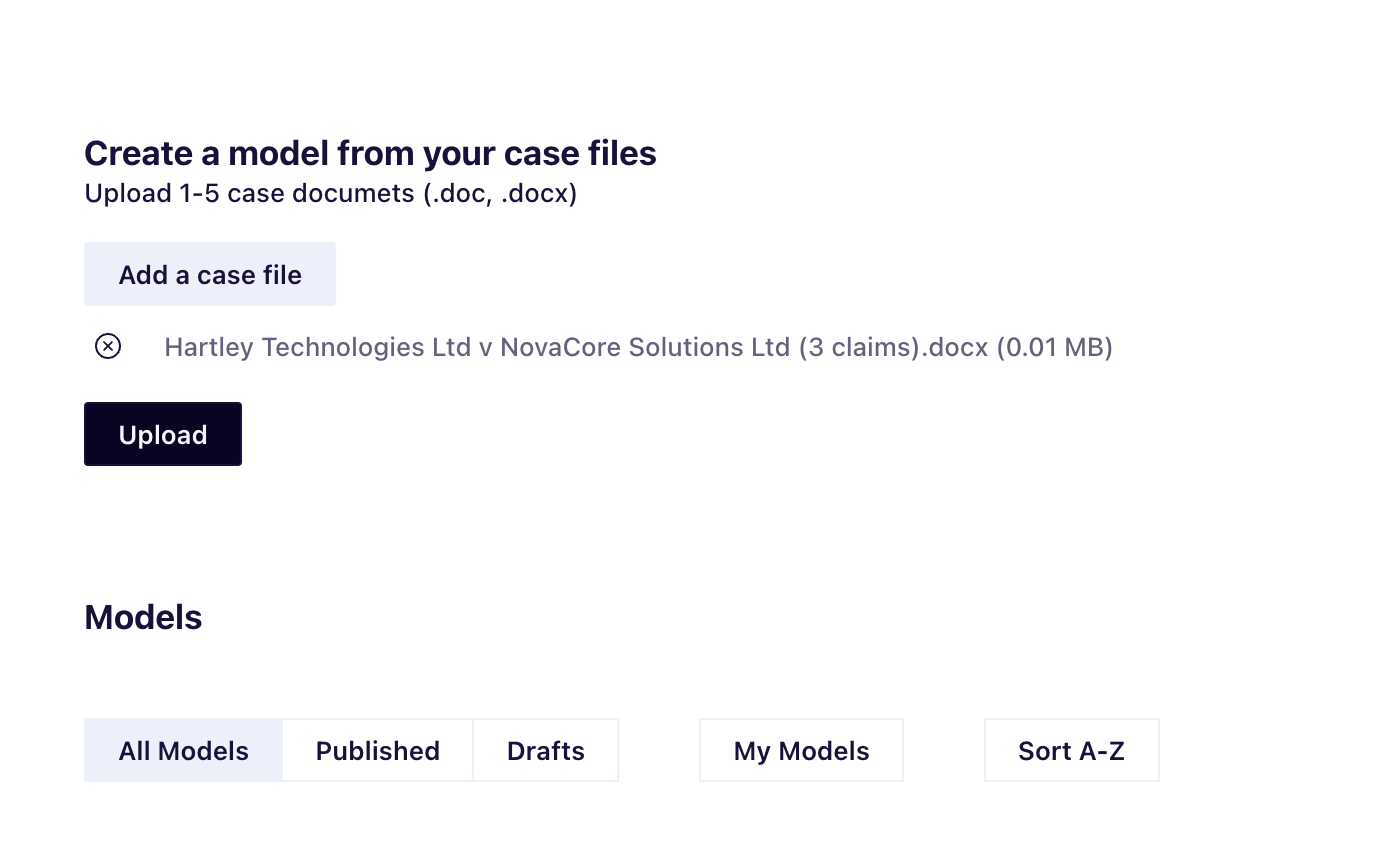

The adoption of leading-edge software provider SettleIndex (www.settleindex.com) will give all those responsible for legal dispute management a great step forward in managing, reporting, processing, and most importantly settling cases at the optimal value.

Assets and liabilities

SettleIndex enables corporate users to view and treat legal disputes as the commercial assets or liabilities that they are and, based on its output, plan the investment of time and money, internal and external reporting, and overall strategy that goes with them.

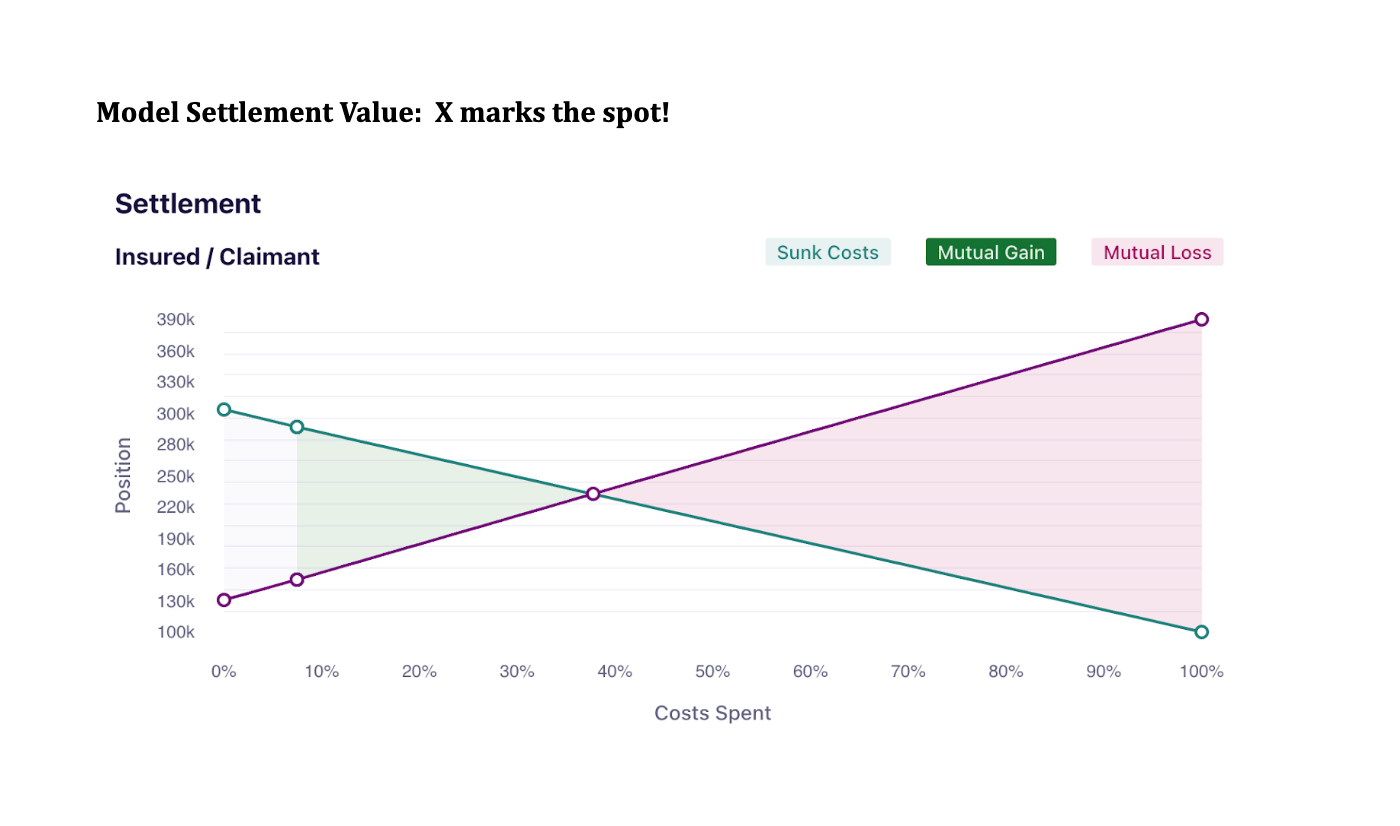

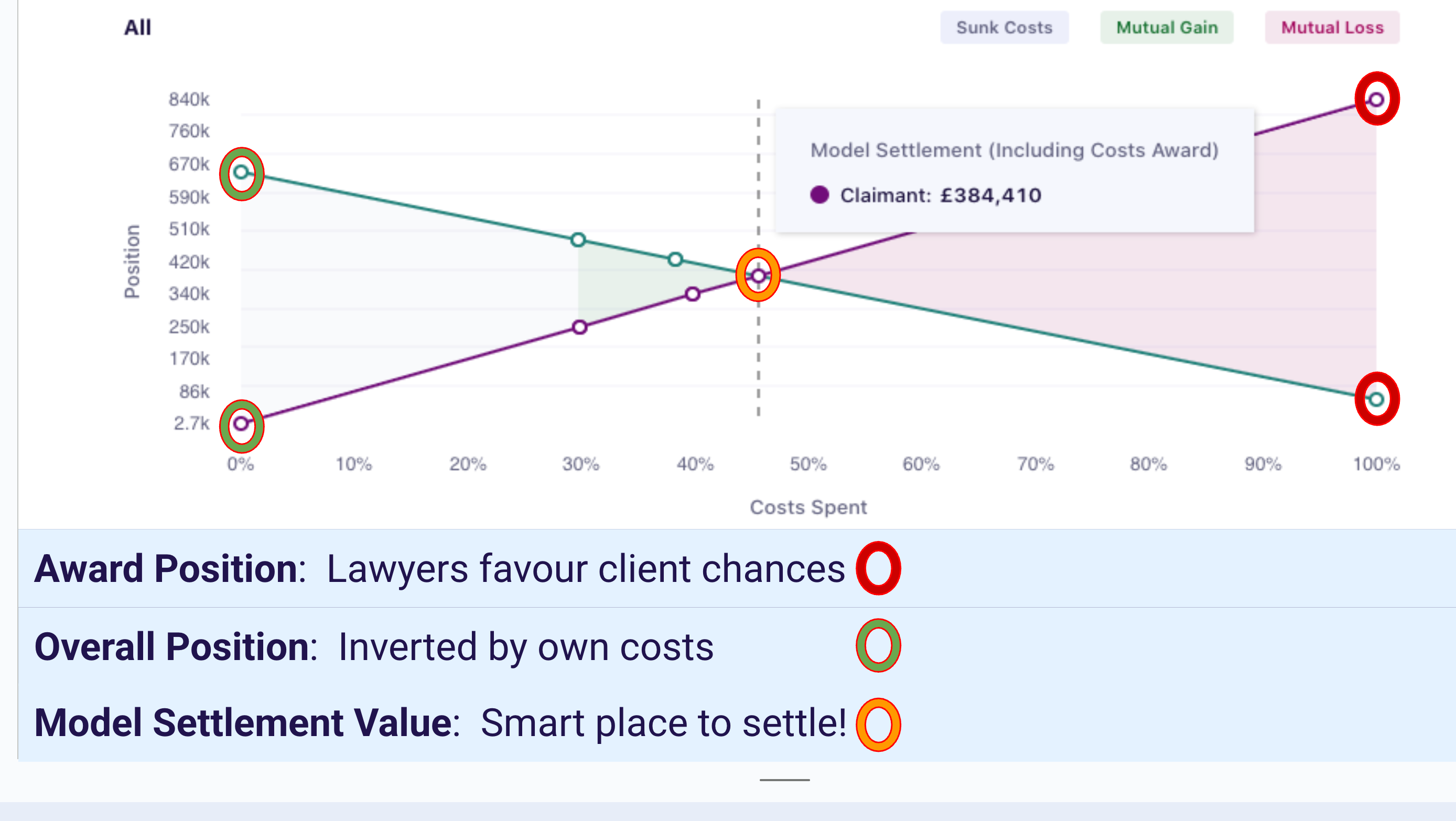

It facilitates streamlined conversations and collaboration between internal or external lawyers and the internal business clients. As it produces its output in the form of easy-to-understand graphs and charts it speaks the business clients’ language in a way that they can readily grasp without having to plough through legal narrative, meaning that it will be easier and more attractive for them to engage. They will readily be able to see the relationship between a legal dispute and their budgets and forecasts and forward planning. The tool will enable them to experiment with different potential scenarios in real time and will also provide data in formats that can be used in presentations, and which can be collated for use in future disputes.

Following on from this SettleIndex also facilitates conversations and collaboration between internal and external lawyers, and internal business clients, with finance departments and external auditors, by providing a trackable and auditable process showing how valuation conclusions are arrived at. This is valuable in accounting and reporting conversations about taking (or not taking) provisions and/or acknowledging contingent liabilities. It enables corporate users to provide evidence-based assurance to finance departments and auditors about the accounting impact of legal disputes.

SettleIndex can also support corporate governance in facilitating reporting to boards, and finance, audit and risk committees, providing trackable and auditable decision-making processes to deliver the assurance they need, and useful charts and graphs that can be exported into committee meeting packs.

Consensus

SettleIndex can promote consensus among groups of stakeholders in legal disputes. Commercial disputes often involve many stakeholders, some of whom may technically be formal parties to a case and some of whom may not. Ultimately many or all of these stakeholders may need to be engaged for a successful settlement to take place.

For example, banks may be involved in syndicate cases, where syndicate members need to approve key actions. It can be the case that syndicates see a need or have a will to settle but find it difficult to agree on the right level. By setting a benchmark valuation (based on a trackable and auditable process that individual banks can consider and discuss internally) SettleIndex can make it easier for syndicates to coalesce around agreed figures.

A similar situation arises in connection with supporting decisions of creditor committees in insolvency cases (where corporates may find themselves included when pursuing debt). The SettleIndex valuation provides a figure that promotes consensus on value between creditors and insolvency practitioners.

SettleIndex is also useful where insurers are involved in legal disputes, for example when providing cover to a defendant. It enables insurers and insured to have sensible conversations about case and settlement values (and also for insurers and reinsurers to have those discussions amongst themselves).

It can help when regulators take an interest in corporate legal disputes, as they sometimes do, providing trackable and auditable assurance.

It can help when discussing legal dispute funding with funders, who will expect parties seeking funding, and their lawyers, to have a clear concept of the value of their cases, especially taking into account the costs impact on these.

In class actions SettleIndex can provide evidence to a class of the number at which they should sensibly settle.

And of course, SettleIndex can be used in mediations, either by all parties agreeing to use it, or the mediator using it.

The Legal Department

SettleIndex is a great tool for corporate legal departments, and not just in easing individual case valuation, management and settlement.

Because use of SettleIndex enables collation of data by users, legal departments will soon be able to start building up a data rich picture of the legal disputes portfolio that can lead to overall savings through better case strategy and iterative learning.

Corporate legal departments sometimes struggle to demonstrate their value to the business and contribution to the bottom line and are usually seen as a cost centre rather than profit centre. Using data collated by SettleIndex legal teams will be able to calculate and show their financial savings to the business from advantageous settlements of claims. SettleIndex’ creates value to corporates both case by case and across the whole portfolio of disputes; helping to manage them in a commercial and business orientated way. This brings stakeholders together and promotes the value of the in-house legal team.

Please find out more at www.settleindex.com

Helen Dodds

Helen Dodds is an international lawyer, consultant and board member. She advises on ways of better legal dispute management in the UK and abroad, and the digitisation of dispute management. She was for many years the Global Head of Legal, Dispute Resolution at Standard Chartered Bank, and is a former member of the board of the London Court of International Arbitration.