Throughout the life of a liability claim, you make strategic decisions whether to settle or fight, based on an assessment of what the claim is ‘worth’. In the majority of cases, you and the claimant will choose to settle rather than face the unknowns of a trial. This makes finding the optimal settlement amount a critical step.

How do parties assess risk now?

The settlement deal may be based on calculations, but often it is just an intuitive assessment of ‘risk’ based on experience. The risk being weighed is where the deal sits in the panoply of better and worse outcomes if you don’t settle. In typical cases where lawyers are involved, the risk is heavily skewed by their costs. The parties frequently choose a disappointing deal rather than incurring the costs associated with going to court. This is why mediators say that often a good settlement is one where neither party is happy with it!

The difficulty for participants lies in identifying which legal principles apply to the dispute and how they may shape a formal award. The claim is disputed precisely because there is no objective answer. All that can be assessed is what the chances are that the judge will decide the various component issues in your favour. One certainty is that each side will skew their assessment of those chances in their own favour. This ‘partisan role bias’ is well documented and one of the root causes of delay and cost in dispute resolution. Typically, the claimant always believes the value of their claim is higher than the defendant does.

Does more investigation = better settlements?

The big question is, once each party establishes their position on risk, will their perception of it change prior to the dispute settlement? Primarily, the processes that proceed while the case is unresolved focus on presenting the evidence in its best light to the court and only tangentially touch on risk assessment. SettleIndex’s tests suggest that, after initial assessment, the perception of risk on both sides does not change very much; certainly not proportionately to the cost and time involved. So could there be a better alternative to preparing for a trial which probably won’t happen?

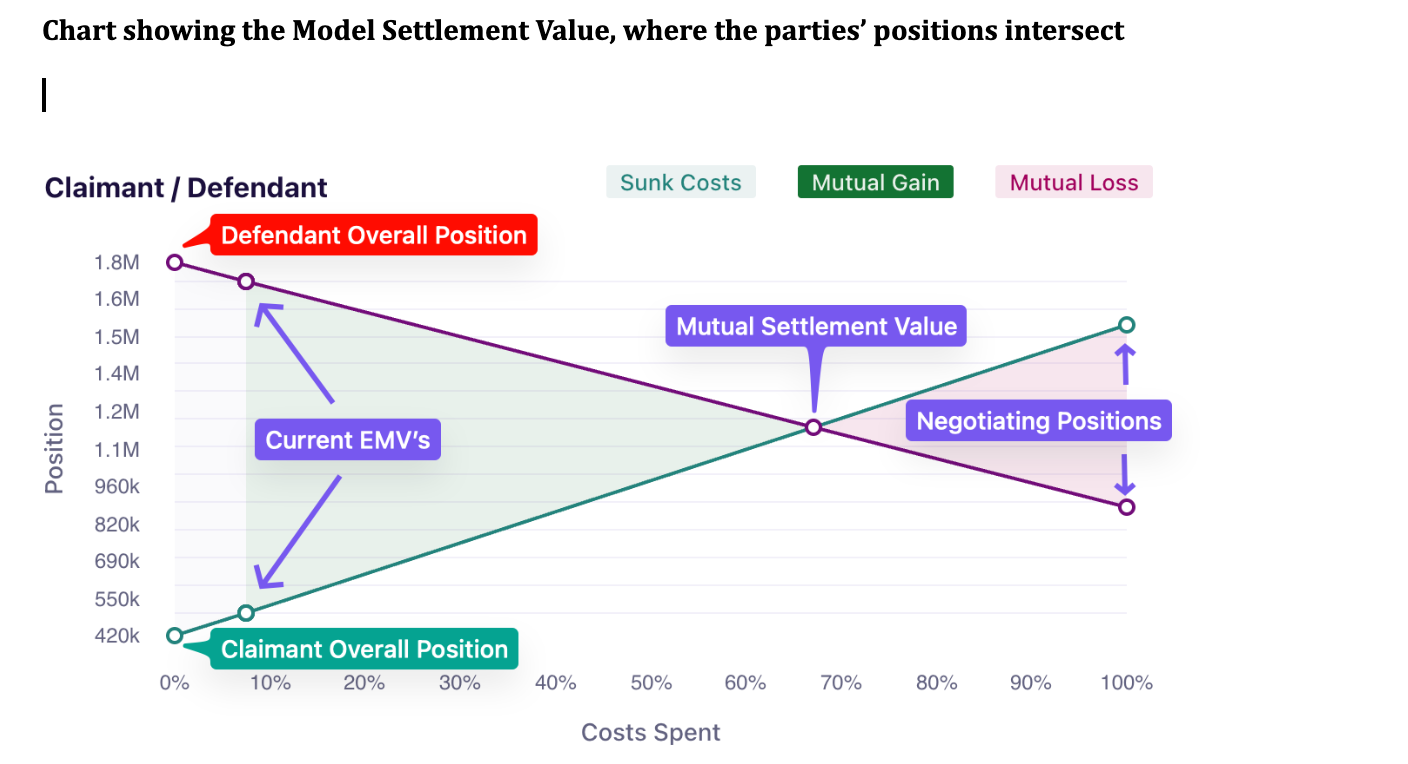

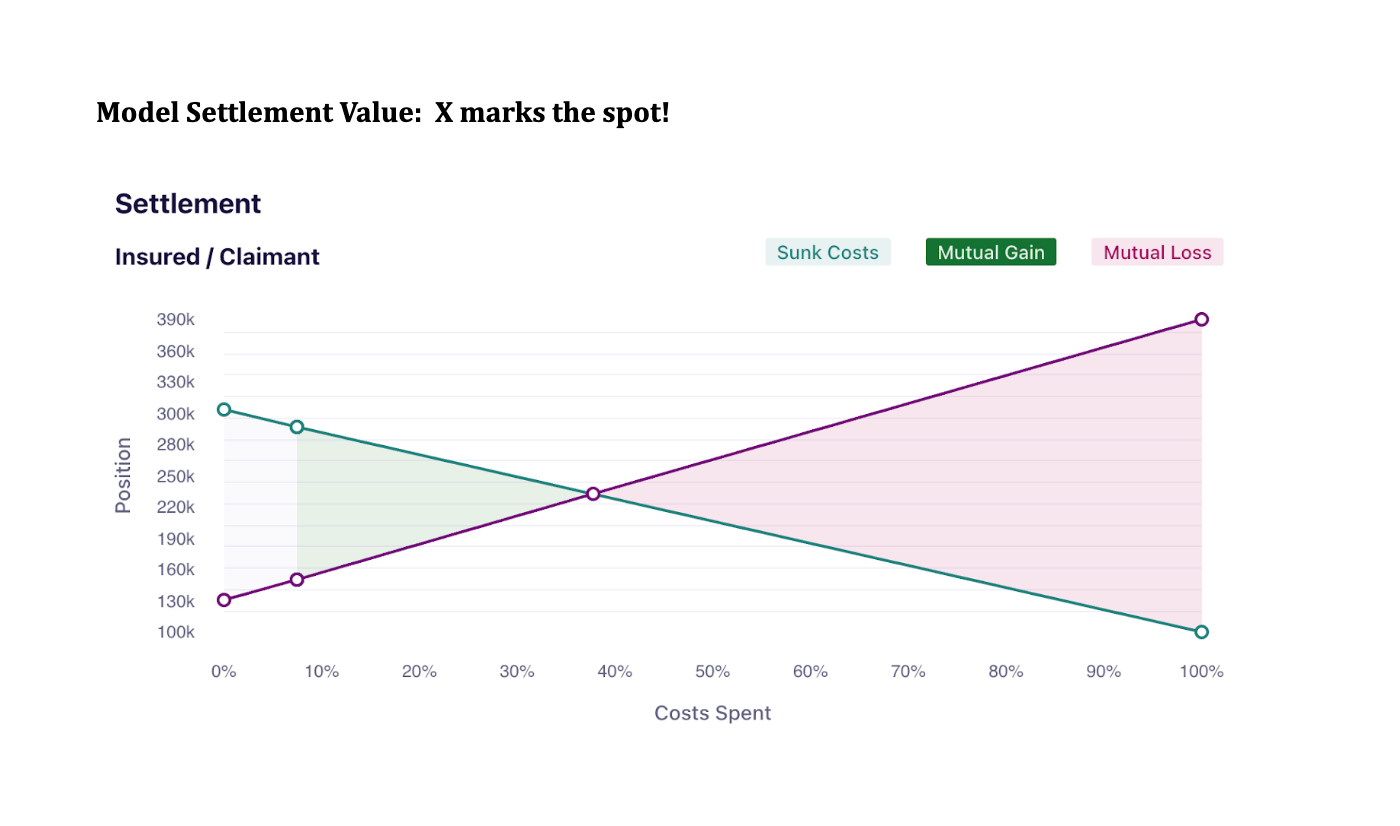

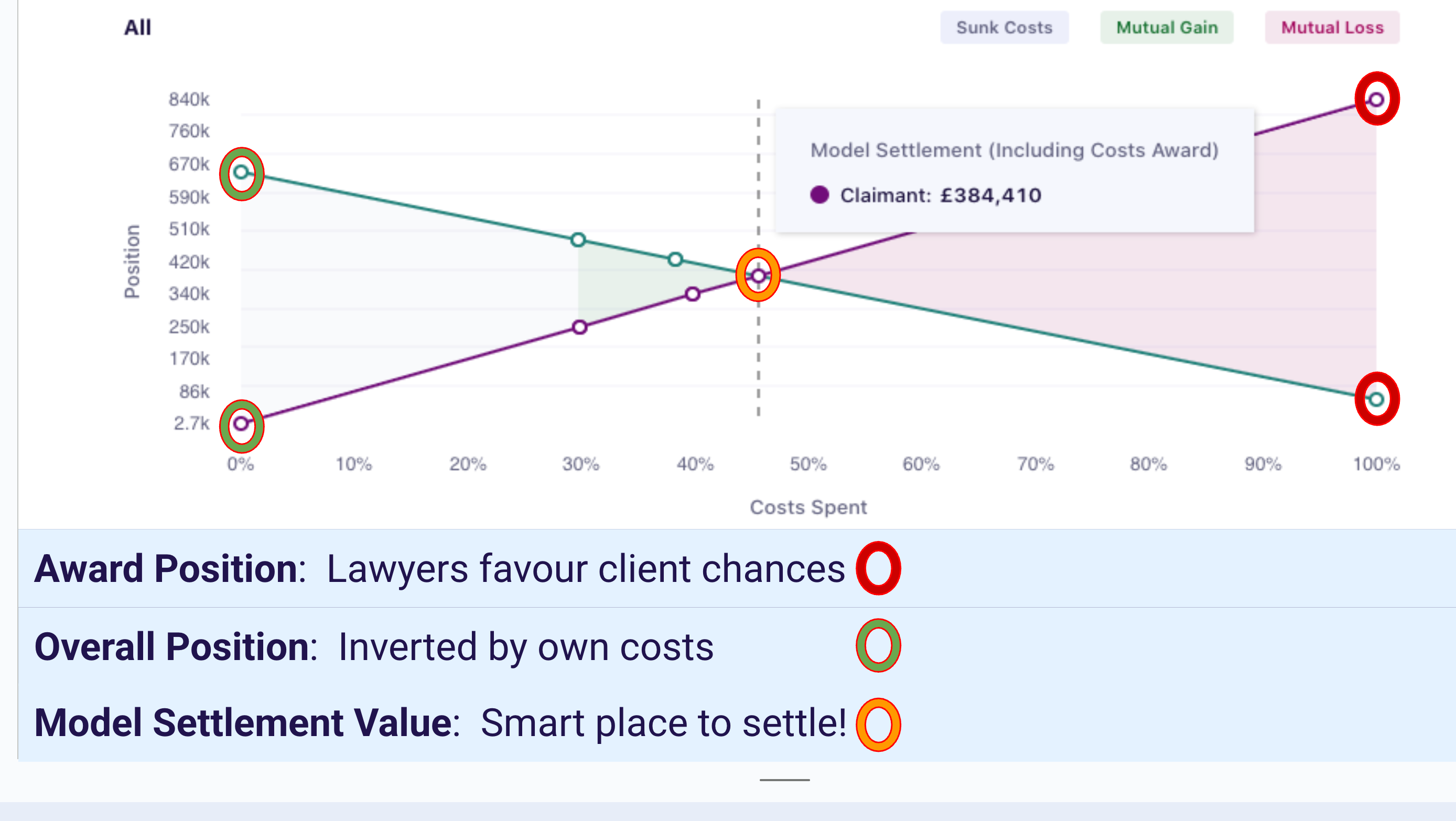

You will not be surprised to hear that there is a better way! Traditionally, litigation risk modelling has been directed at assessing the Estimated Monetary Value (EMV) of a party’s case. It is a more sophisticated approach than the traditional intuitive approach, but generally suffers from being one sided, subject to bias, and a poor predictor of settlement value. The best modelling protocol is to model the risk from both sides, enabling a calculation of where the parties are most likely to compromise in the end. When you include each party’s costs, it reveals that at the outset of most cases the defendant EMV is much higher than the claimant EMV.

This means it should be easier for the parties to negotiate a ‘win/win’ settlement early on. It also reveals that the longer the parties prevaricate over settlement, the worse the settlement becomes for both parties.

Shifting the process towards risk valuation

Getting the parties’ focus away from process and onto risk early in the life of the dispute can be a challenge. SettleIndex can automatically create a ‘benchmark’ valuation of the dispute to share with the claimant called the Model Settlement Value (MSV). In effect, this creates a ‘neutral third party’ recommendation for settlement and can shorten claimant ‘churn’. SettleIndex testing suggests that, on a portfolio basis, significant savings would be made by settling early at the MSV. This is because the MSV is a good predictor of the compromise the parties are likely to reach between their negotiating positions (see above).

If the parties adopt the MSV, they will, on average, have a more positive outcome than leaving the case to take its ‘usual’ course. However, both parties can take the benchmark model and change any numbers to reflect their alternative view of the chances. If this prolongs the dispute, the software will show whether there was any net benefit in the delay when it finally settles. For at least one party – and often, both parties – there will not have been any benefit.

With the ability to create benchmark models from uploaded claim documents, the cost of adopting systematic litigation risk assessment is minimal. The ability to generate the MSV against claim documents means that you can test for yourself on closed cases how closely mathematical modelling would have predicted the eventual settlement. Once you have confidence in modelling, you can implement it on live cases and measure the savings.

SettleIndex is part of the Guidewire’s Insurtech Vanguards program. For a more detailed introduction to dual sided dispute modelling see this article: Meet me in Seattle

Robert Hogarth CEO SettleIndex