London, UK / 1 February 2022 – SettleIndex today announces the launch of its new risk and decision analysis platform, enabling lawyers and clients to assess, track and analyse litigation. With SettleIndex, lawyers can create financial models for disputes, track case progress through key performance indicators, and collect and analyse structured data on litigation.

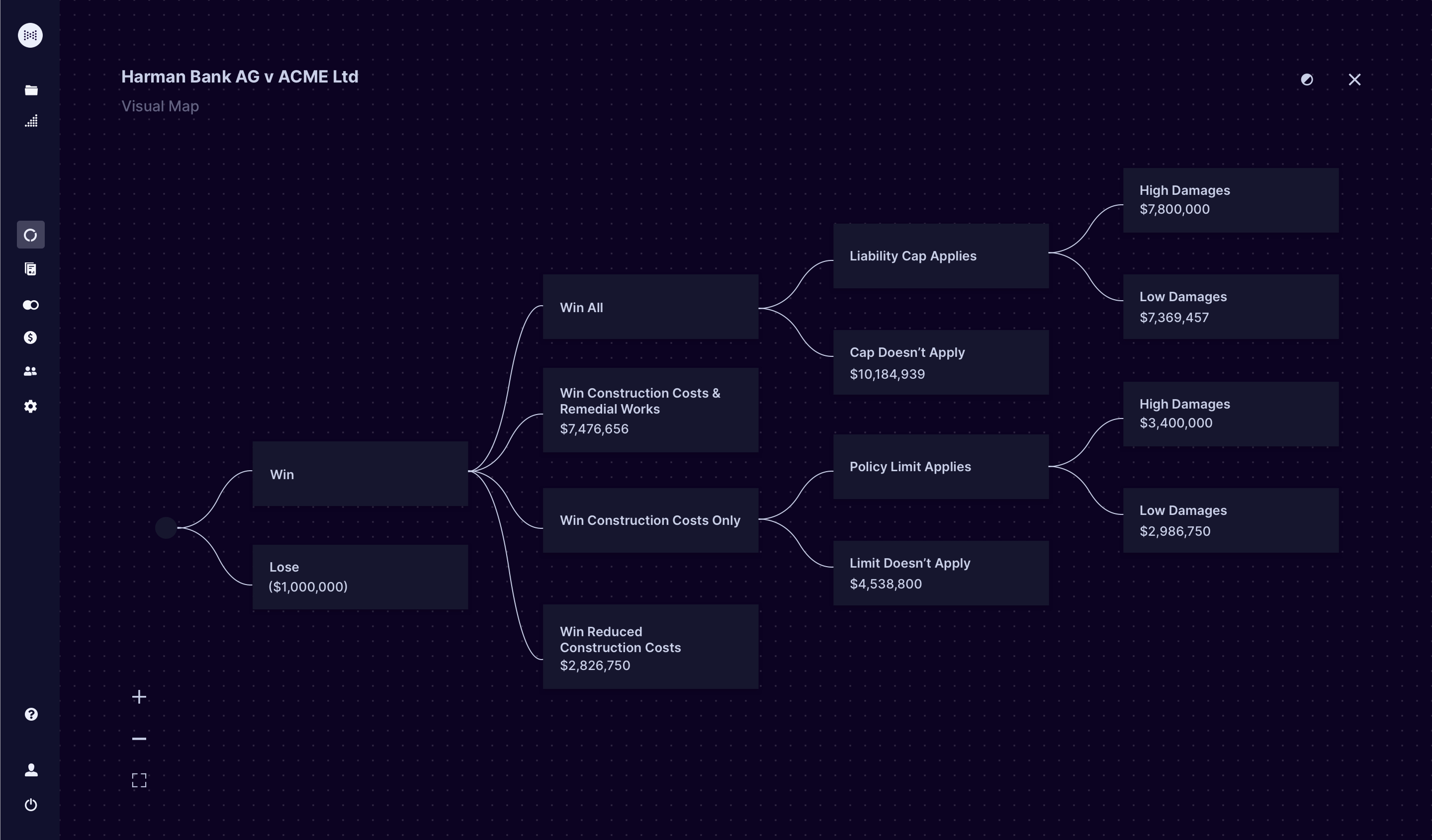

Financial modelling for litigation is at the heart of the platform, which lawyers can use to assess the value of a dispute and identify settlement values between parties. Based on the principles of decision analysis, the software augments lawyers’ professional judgment, enabling them to model potential outcomes, simulate opponent viewpoints, and evaluate settlement strategies.

The SettleIndex platform also provides a comprehensive solution for monitoring cases and collecting structured data on litigation. The financial modelling creates a range of metrics and performance indicators that law firms and clients can use to see case progress and the ability retrospectively to audit decision-making. Over time, clients can build up proprietary structured data sets to inform future litigation strategy and measure performance.

“Financial modelling is a crucial part of every financial dispute. To advise a client properly on settlement, you need to know what a case is worth. With SettleIndex, lawyers can communicate the financial risks involved in a dispute and work better with their clients,” said Robert Hogarth, Co-Founder and formerly Senior Partner at RPC in London. “We want to take financial analysis from a niche activity to something that’s mainstream in litigation by making it simple, intuitive and powerful.”

“Law firms are increasingly turning to data to inform litigation strategy, but over 90% of cases are settled privately, and structured data often isn’t collected. SettleIndex empowers clients to build up invaluable comparative data across cases for future decision-making,” said Zac Best, Co-Founder.

The company was founded in 2020 and is targeting both law firms and corporate clients. One of its founding clients is Morgan Sindall Group plc, the publicly listed construction and regeneration group. Helen Mason, General Counsel, commented: “We utilised SettleIndex on a piece of litigation last year and were very impressed with the ability of the software to evaluate risk in our disputes. As a result, the legal team have decided to roll out the use of the software across the Group.”

The company is also focused on the insurance market, one of the largest buyers of litigation services. According to the EY Accord P&C Analysis 2020, a study of the US’s top 100 property and casualty insurers, loss adjustment expenses account for over 11% of overall losses. The cost of litigation in casualty claims and coverage disputes is a significant contributor to this. The firm believes a more data-driven approach to handling claims in litigation can help insurers reduce costs and increase case reserve accuracy. Last year, the firm was selected from over 177 applications to participate in Lloyd’s Lab, Lloyd’s of London’s highly regarded innovation accelerator and the product is already in pilot with a multinational insurance firm.

About SettleIndex

SettleIndex is a risk and decision analysis platform that enables lawyers and clients to assess, track and analyse litigation disputes. The software features financial modelling, reporting and key performance indicators, and structured data collection and analysis.