How early settlement benchmarks bring speedy settlement, cost savings and better governance

One of the persistent challenges in liability portfolios is not a lack of expertise, but a lack of comparability. Claims evolve through multiple handlers, advisers, and negotiation stages. How do you measure whether the process added real value?

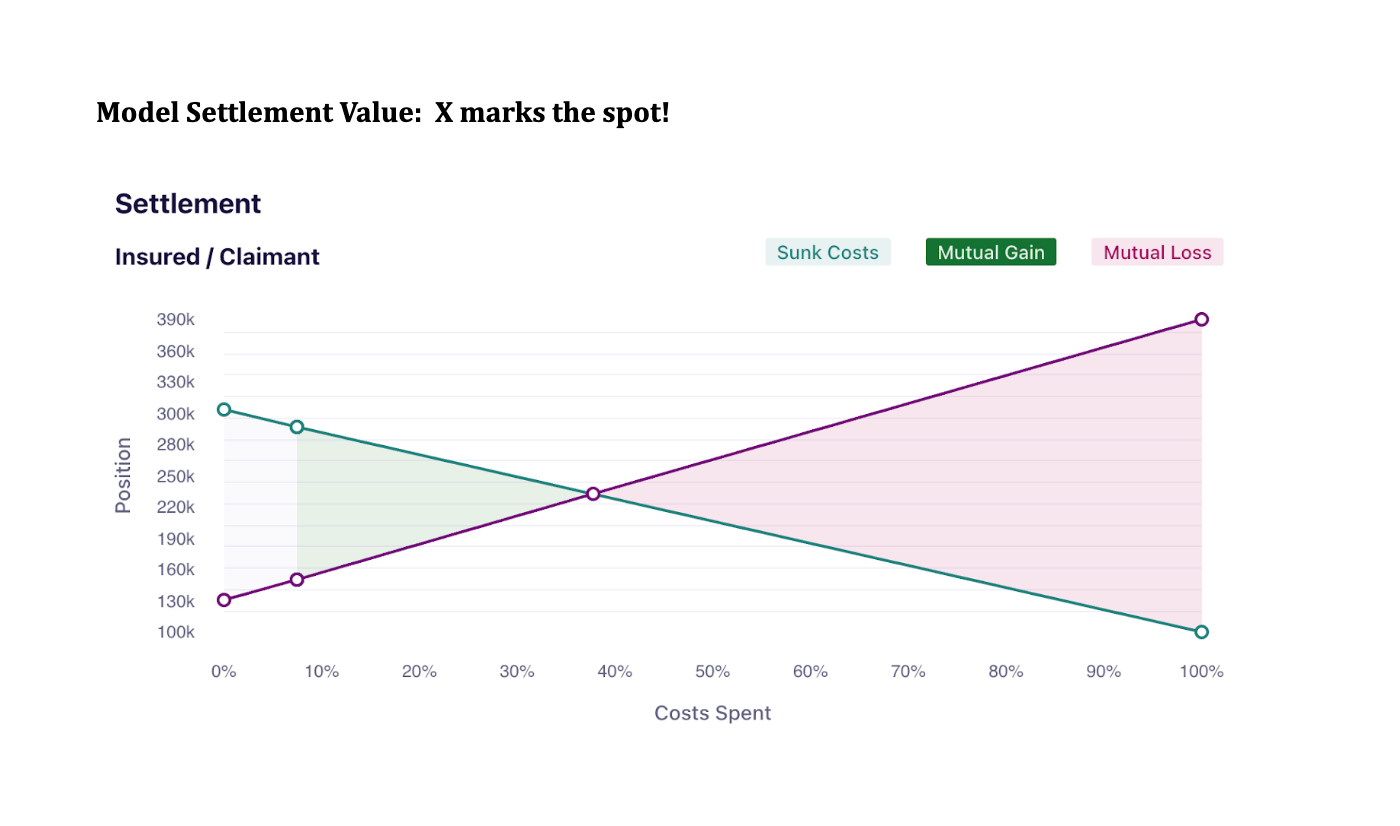

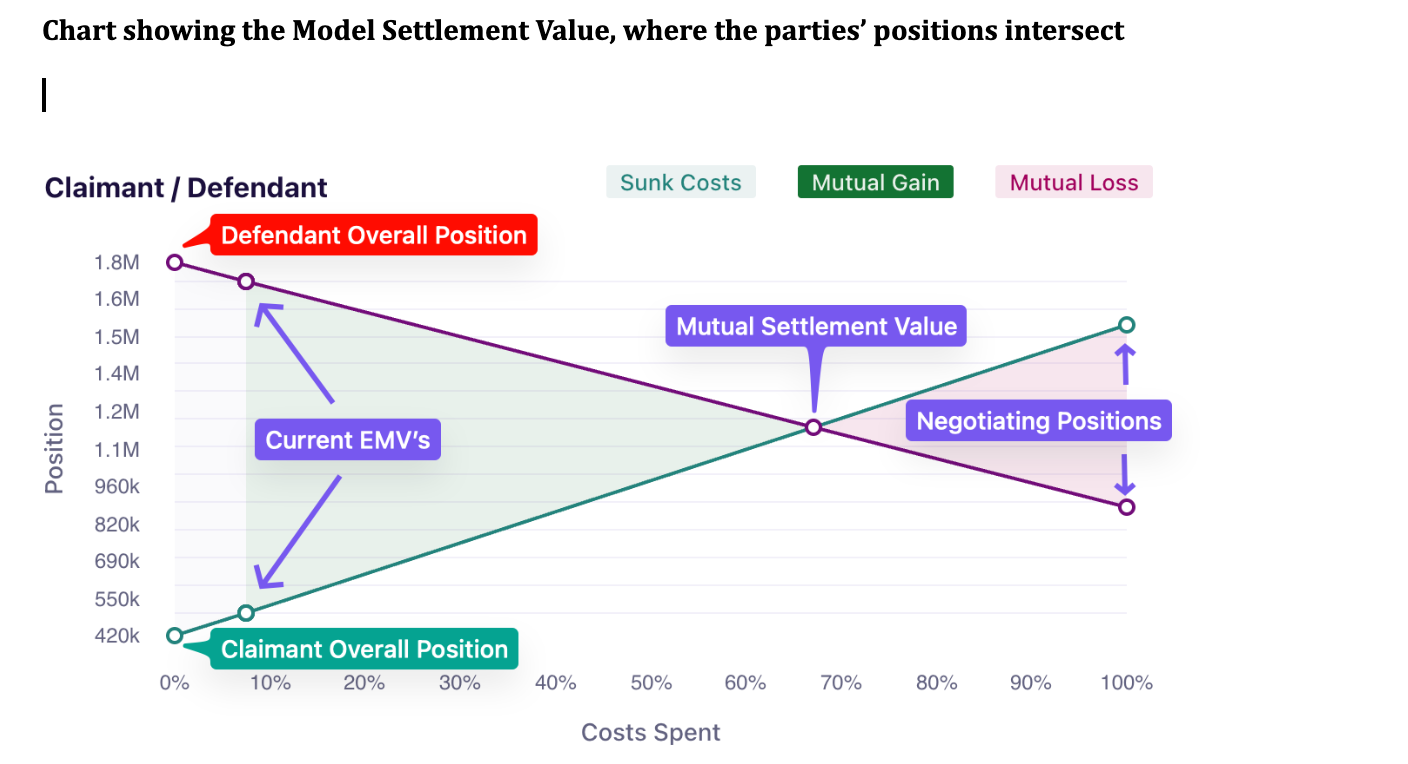

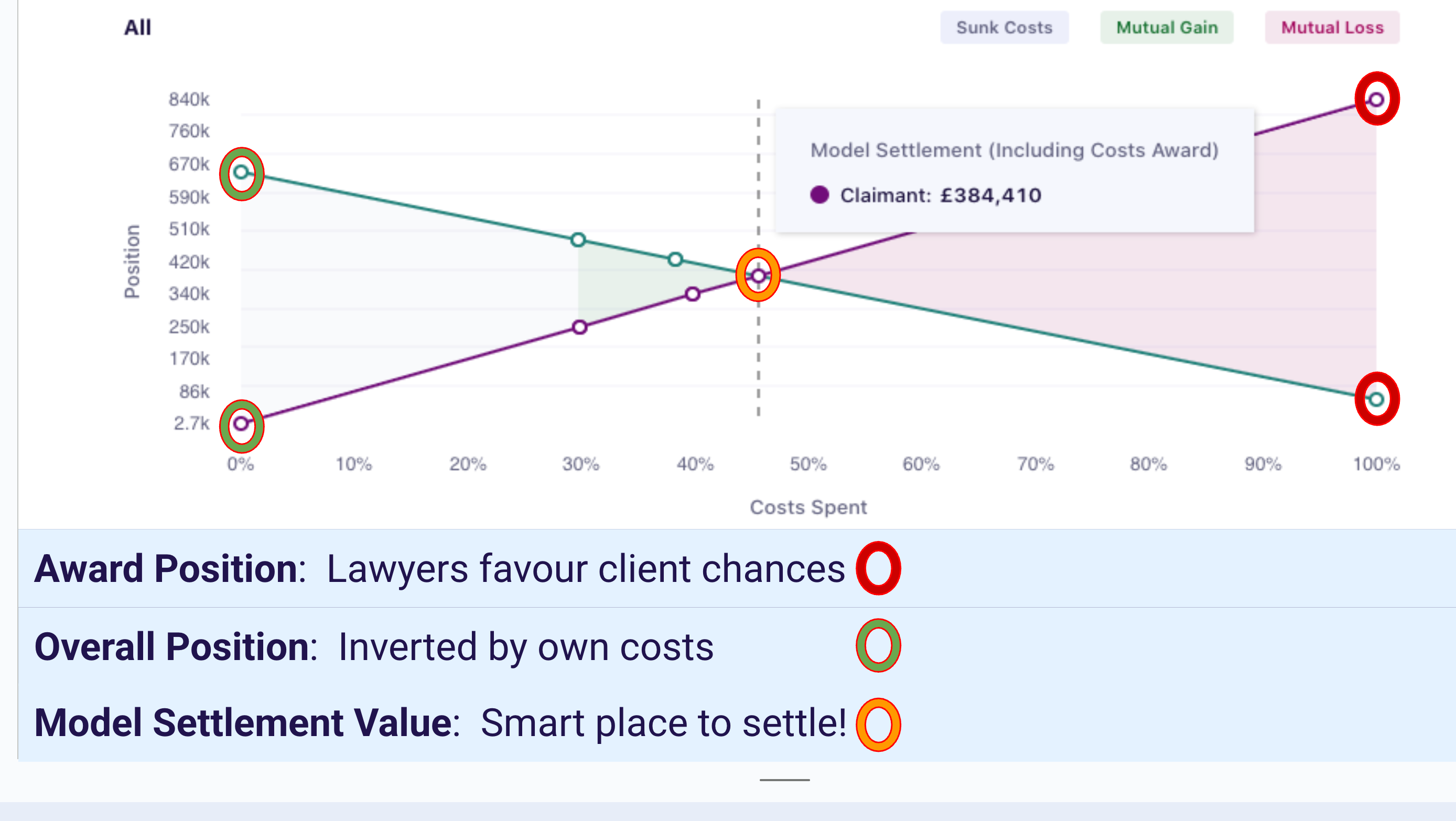

SettleIndex addresses this gap by generating our unique ‘Model Settlement Value’ (‘MSV’). We intend this to become the industry standard benchmark for settlement, governance, reserving, and review. We liken it to a Moody’s rating system – but for individual disputes.

A consistent reference point for oversight and reserve discipline

SettleIndex generates a probability-weighted forecast of settlement value using a structured financial model. We create this automatically from either the letter of claim or the pleadings. No other user input is required. The MSV represents the fair settlement value between the parties. That is what the parties are likely to agree in the end, but typically only after significant delay and expense.

Because the model is neutral, insurers can share it with Claimants and bring them to the table early in the claims cycle. Importantly the MSV frames the negotiations at the realistic level for the claim. Use our forecast and you stand to make very substantial savings.

For claims governance teams, as well as savings, SettleIndex brings consistency. The model created can be freely adjusted by users, but the MSV is a universal benchmark against which reserve movements, negotiation strategy, and settlement outcomes can be monitored over time.

Because the model structure is transparent, you can trace shifts in valuation to specific changes to inputs rather than informal judgment alone. This supports stronger audit trails and clearer explanations to internal stakeholders, reinsurers, and, where relevant, regulators.

Measuring whether process actually adds value

Our early testing suggests that prolonged handling activity does not significantly affect outcomes. Extended negotiation, additional expert evidence, and revised legal strategy always increase cost; but mostly do not improve the eventual settlement value. SettleIndex tracks how user adjustments to model parameters affect net results.

This makes it possible to assess whether later-stage activity produces a better net outcome for the Claimant and a lower overall cost for the Insurer, or whether it simply consumes additional budget.