Never Split the Difference? Is the FBI right in saying it’s a cop out?

Does this FBI advice never to split the difference work for civil disputes?

Improve outcomes and reduce risk through financial modelling, risk analysis and litigation data

Model financial outcomes with a solution tailored to the litigation process.

Build decision trees, quantify risk and identify settlement opportunities.

Monitor case progress, get visibility over volume litigation and learn from data.

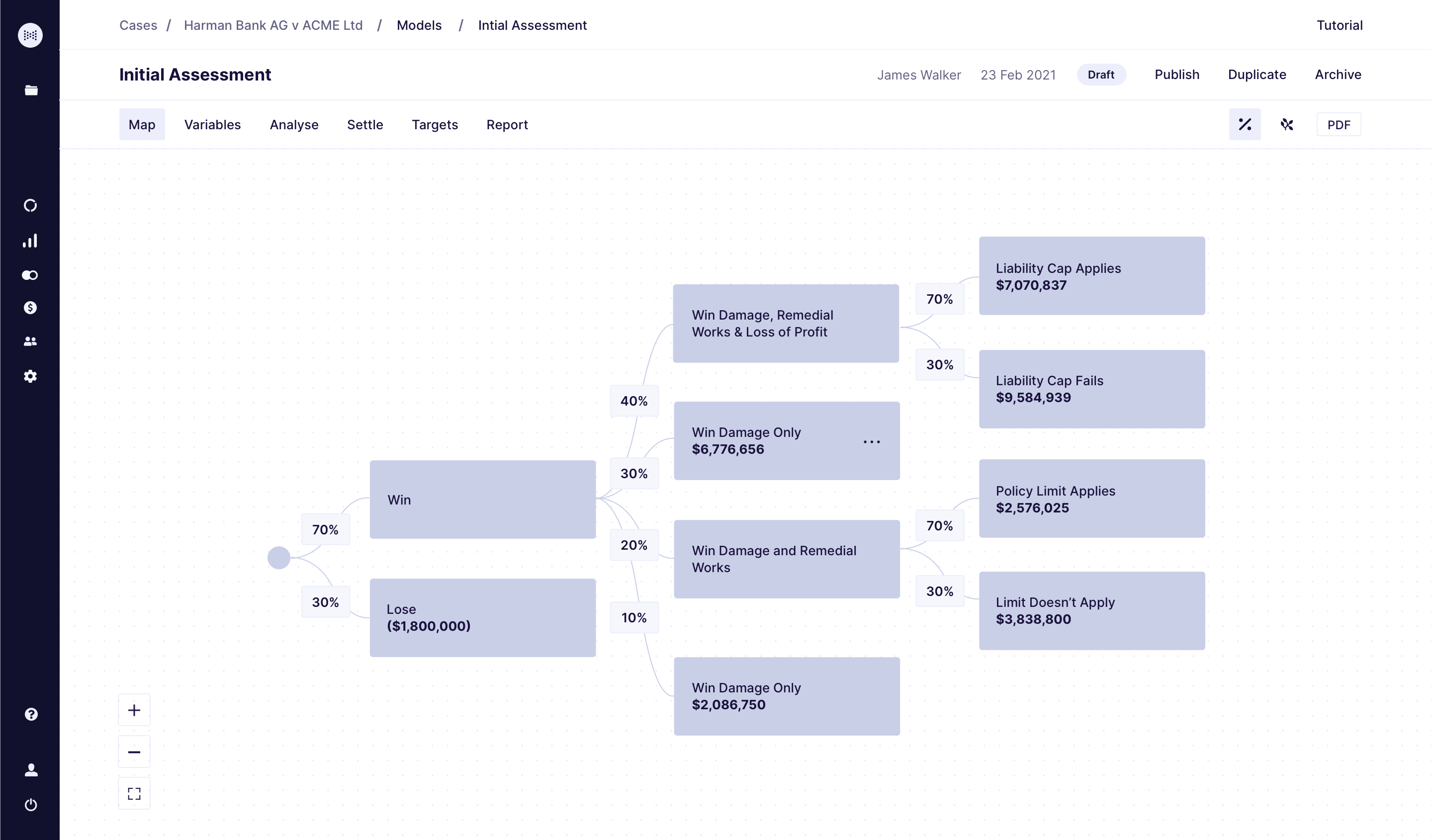

Visualise scenarios and decision points with interactive decision trees underpinned by powerful financial models.

Build detailed economic models for outcomes with an intuitive interface tailored for the litigation process.

Model damages payable or receivable between parties in different outcomes.

Understand the impact that recoverable and irrecoverable costs have on the value of the case.

Include projected cost recovery or opponent costs payable.

Model the impact of interest on damages and the impact of differing interest rates in scenarios.

Model the impact of contractual caps, insurance policy limits or solvency issues.

Model conditional fees and damages-based agreements and view the impact on all parties.

Manage client expectations and inform strategy with a range of ways to analyse and visualise risk in litigation.

Analyse the probability of outcomes occurring and identify the most likely scenarios.

Create clear cost/benefit analysis of litigation or settlement for clients.

Compare strategies or differing opinions and decide on the optimum route based on risk.

Simulate opponent viewpoints, identify settlement opportunities and evaluate offers with a powerful platform for settlement analysis.

Simulate opponent viewpoints, behaviour or psychology and understand the impact it may have on settlement strategy.

Identify optimum settlement ranges and values between parties based on the relative risk to each side.

Monitor case progress with comparative metrics, cut through the noise with visual dashboards and quickly identify how cases are progressing.

Get comparative metrics and key performance indicators for cases and enable partners, managers and clients to assess performance.

Cut through the noise with precise financial data presented in visual dashboards. Quickly identify opportunities, potential losses and cost savings.

Get an at-a-glance overview of how key metrics have changed throughout the case and retrospectively audit decision-making.

Valid in all legal jurisdictions and can accommodate local legal practice.

Independently audited and compliant with international information security standards.

Get help in real time with live chat support included on all plans.

Does this FBI advice never to split the difference work for civil disputes?

It is a cliche of decision tree analysis (and a true one) that what you have already spent in pursuing or defending a claim is not relevant to evaluating its settlement value. If you must sink costs, be seen to sink them wisely!

How Settleindex could have saved $300,000 and 8 months!

This case study shows how SettleIndex can reduce the cost of resolving disputes.

Knowing your own position is not enough. In this short article we explain how the Settle Chart works and how you can use Opponent Values to identify the shared Settlement Position.

BIICL guidelines for Resolution of Disputes include to carry out an objective assessment of the dispute, narrow the issues and to engage in ADR wherever possible. These recommendations are well served by the use of SettleIndex.

Calculating the value of an uncertain event, such as the Outcome of a Trial, is an established branch of mathematics. Now, with its new Casebot, SettleIndex has for the first time made it easy for any lawyer to use scientific principles for estimating the settlement value of disputes.

Book a short demo with our team to find out more about SettleIndex and what it can do for your organisation.

Get in touch with us today if you want to learn more about SettleIndex or arrange a meeting.

© SettleIndex Ltd.