Litigation as gambling

Calculating the value of an uncertain future event is an established branch of mathematics. The first formal paper on the subject was published by Daniel Bernoulli in 1738. It is highly relevant to resolving disputes. Anyone who has ever lost a case will be painfully aware that a trial is an ‘uncertain future event’.

The general principle is fairly well understood. If I roll a die, the chance of any number is 1 in 6. If I stand to win £60 on that roll, the value of the opportunity is £10 (60/6). If the cost of participating each time was £9, over a large number of rolls I would make money. If the cost per roll was higher than £10, say £11, then over the same number of rolls I would expect to lose. This is something Mr Micawber would have understood well.

Having a dispute decided by a judge or arbitrator is a game of chance to which Bernouilli principles apply. There are however two unusual features that distinguish formal dispute resolution from typical forms of betting:

- The parties can, and generally do, negotiate a financial alternative to metaphorically rolling the dice. For this reason it is critical over a large number of cases to use the best methodology for valuing the risks comprising the commercial asset or liability represented by the dispute.

- The stakes in litigation are not calculated by reference to the value of the reward. The stake is the cost of getting a decision – mostly legal costs. They relate mainly to the amount of work to prepare for having the dispute decided, not the value and chance of winning. Sometimes the costs can make the dispute worthless to the Claimant, other times they can offer a handsome return.

Key uncertainties in Disputes

In fact the matrix of uncertainty in litigation is more complex than in many forms of gambling. Therefore applying Bernoulli principles to valuing the interlocking chances requires a lot of calculations, mostly the compounding of estimated percentage chances of myriad possible awards that the Tribunal might make. In a typical litigation risk assessment you have to deal with the following uncertainties:

- success on issues that determine liability.

- The categories and levels of damages that might be awarded.

- The likelihood that you will actually be paid some or all of an Award.

- The impact of another party making a contribution (another defendant, a third party or the Claimant via contributory negligence).

- The likely cost Awards in jurisdictions where costs can be awarded to the parties.

- The incremental expenditure of costs, the timing of which impacts the overall value of settlement.

The matrix in many cases is further complicated by there being multiple separate claims and by some claims giving rise to more than 1 category of damage. These may all operate independently of each other.

And then there are Opponent values! Any party settling for the Estimated Monetary Value of their dispute will be putting or leaving money on the table. So to do a proper assessment you have to incorporate complementary Opponent values in your calculations.

The phrase Estimated Monetary ‘Value’, is a dangerous misnomer in the context of settling disputes. The ‘Value’ of the case is only and exactly what the parties agree when they reach a settlement. The overall EMV of opponents will always be different, even in the very unlikely event they both exactly agree on chances of winning and the values of claims.

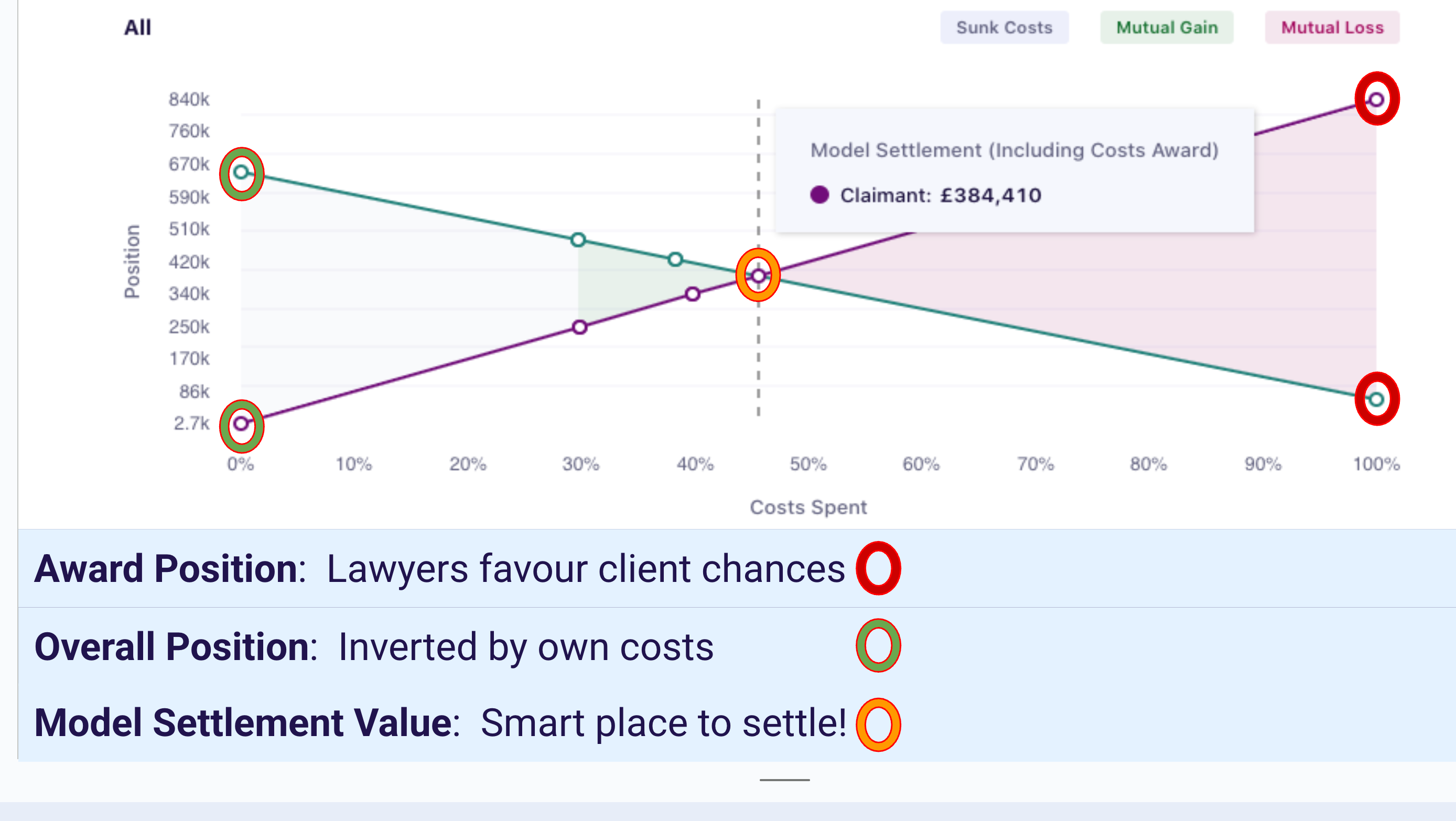

For this reason we refer not to ‘EMV’ but to ‘Positions’. If you know your Position and make a good estimate of your Opponent’s, then you will have a good idea where it is likely to be possible to compromise the case and thereby crystallise its final value. Forming a view about both Positions is important for identifying a likely compromise.

The Casebot: Quick and Easy!

Lawyers have for many years have had to manage without doing these calculations. But the advent of computer software, in particular SettleIndex, removes the need for hunch based or simplistic assessments of risk. ‘Guestimation’ is more likely over time to result in poorer financial performance. Using SettleIndex makes it possible to make better accounting provisions, to settle earlier, to save the parties money and, on occasion, to justify a decision not to settle.

With our newly launched Casebot, we have addressed the historic problem that these calculations are too hard or too fiddly. Our software poses no questions of lawyers that they should not be able to answer about their own cases. It requires them only to identify Issues, Values and Chances, not to design or compile decision trees. It calls for the least possible information (and key strokes) needed to do a given assessment. It allows for the most complex adjustments to be made simply and instantly.

It is the Casebot itself that translates your understanding of your case into a financial risk assessment. This consists of our Map (akin to a decision tree), our Settle Chart (which displays the parties’ Positions as they change with costs expended) and our Analyse Chart. This latter looks not at the overall Positions but the range of potential Outcomes and the chances of beating a settlement offer at trial. With these charts you can make strategic and justifiable decisions about whether to settle your dispute and at what level.

In short, with the Casebot we have made the process of proper litigation risk assessment so simple that there is now no good reason not to adopt it!

For more information contact Robert Hogarth: robert@settleindex.com